Founded in 2017, this Italian PayTech company specializes in digital payments with end-to-end omnichannel technology. As one of Europe’s largest fintech groups, the company manages 2 million merchants, managing 120 million cards, processing more than 21 billion transactions per year.

The goal:

The company needed a tool to help them transform into a customer-centric organisation.

The challenge:

The company struggled to identify critical moments in the customer journey, evaluate pain points, and find opportunities to delight customers. Without a robust Voice of Customer (VoC) solution, there was no way to analyze data and develop intelligent customer-centric strategies.

Without this crucial data, they could not define actions to properly close the Net Promoter System (NPS) customer feedback loop. The NPS feedback loop includes an inner loop, which allows frontline employees to hear customer feedback immediately, and an outer loop, promoting structural improvements within customer support operations.

Additional challenges included:

- Defining and prioritizing initiatives

- Collecting and analyzing customer experience benchmarking data for different touchpoints

- The need to implement new NPS touchpoints to collect and analyze performance data

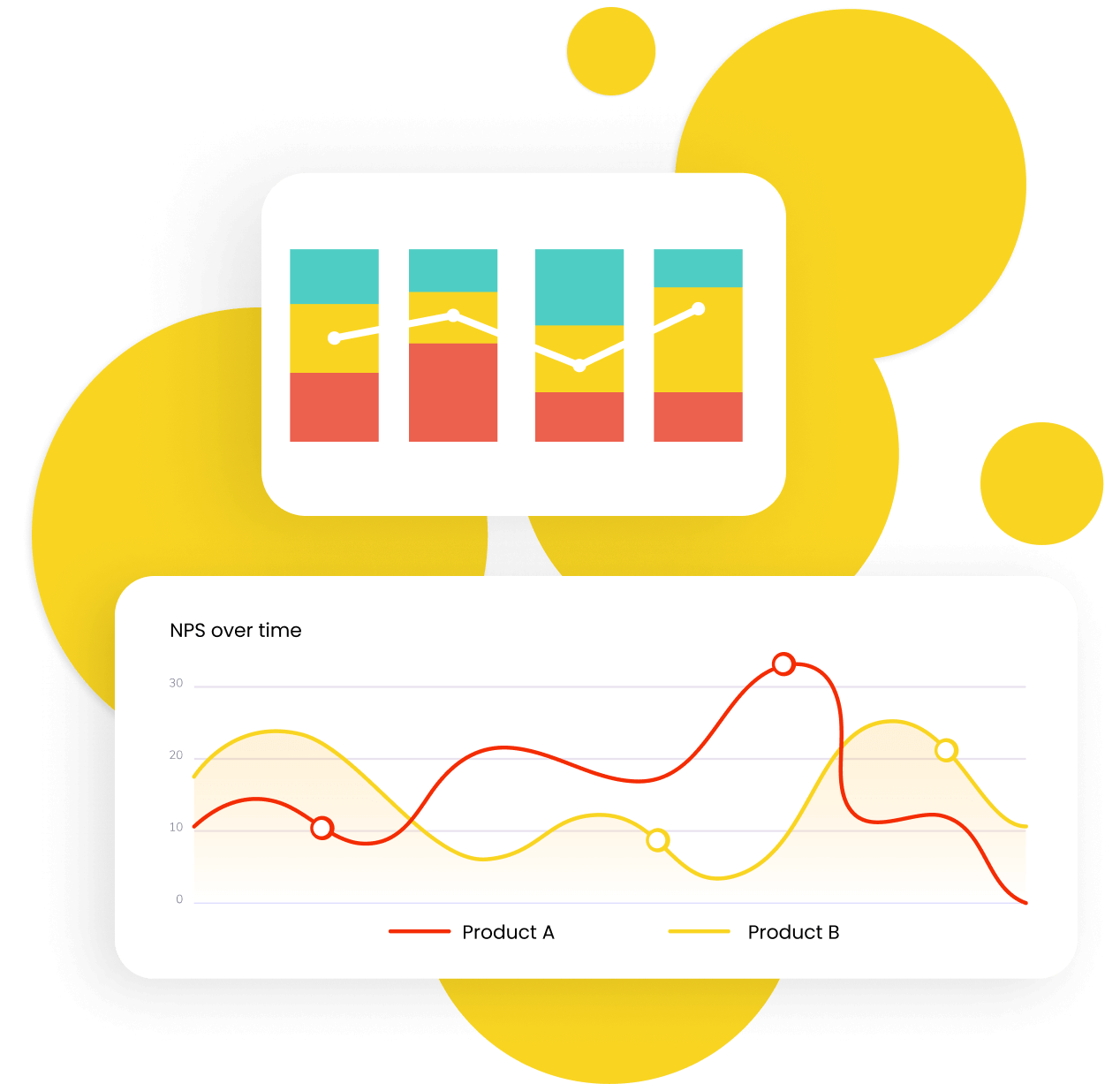

- Lack of visibility into performance and KPIs due to no customer experience dashboards

- Overall culture adoption of customer-centricity across the organization

The PayTech company partnered with SANDSIV to launch our enterprise VoC solution, sandsiv+. The solution is a fully automated customer experience management (CXM) platform that unifies all sources of structured and unstructured customer data into a single repository. With the power of big data and customer intelligence, the company could unlock valuable business opportunities.

The company integrated sandsiv+ into its custom support operations to:

- Migrate historical survey data

- Push surveys through email and SMS to its millions of end-users and merchants

- Provide customizable dashboards

- Publish surveys to ATM and merchant devices

Implementation

Feedback collection

Dashboards

Integration & training

In one year, the digital payments company was able to send out more than 4 million surveys. The company centralized all organizational units across business-to-business (B2B) and business-to-customer (B2C) channels under one VoC platform. Each business unit implemented its own personalized dashboard for deeper insights and KPIs and can now analyse customer data by sentiment and topic.