In the insurance industry, becoming a leader requires more than just offering a quality product; it means fully understanding customer needs. In an ambitious effort to meet these needs, ITAS Mutua launched a 4-month pilot Voice of the Customer (VoC) program for its ITASNOW ski insurance policy.

By collaborating with experts like Applied Consulting, using their Connecting with Customers® methodology to map and improve customer experience, and with SANDSIV for the VOC technology platform sandsiv+, ITASNOW gained a comprehensive view of the ITASNOW customer experience. This was made possible by conducting a detailed analysis of data collected from four key touchpoints, which allowed for the identification of areas for improvement in both the product and operational and strategic aspects.

The results are clear: an outstanding satisfaction level, with 96.1% of customers providing positive feedback, and a Net Promoter Score (NPS) of 42, confirming the effectiveness of the service and the critical importance of active listening to customers for ITASNOW.

Global insurance companies are facing an unprecedented revolution, driven by the need to adapt to the growing digital demands of customers. Instant insurance is completely reshaping access to coverage, emphasizing speed, simplicity, and personalization.

ITASNOW Instant Insurance allows customers to obtain immediate coverage on ski slopes with just a few clicks, directly addressing customer needs in terms of convenience. In such a context, there are numerous challenges, and ITASNOW is committed to delivering a seamless online experience, providing a customer journey that meets expectations.

ITAS Mutua’s challenge was to equip the company with the skills, methodologies, and technologies needed to better understand the voice of the customer, to continuously analyze customer needs, and to respond appropriately to them. Recognizing the crucial importance of carefully listening to the Voice of the Customer (VoC) to maintain a competitive edge, the company formed a strategic partnership with Applied Consulting and SANDSIV. Together, they launched the pilot “Voice of the Customer” program, aimed at continuously improving the ITASNOW insurance experience, anticipating market trends, and effectively and innovatively meeting customer expectations.

Applied Consulting worked with ITAS Mutua’s team to define the objectives of the VoC pilot program, identifying three key areas of focus:

- Monitor overall customer satisfaction, particularly in relation to specific events

- Assess customer willingness to provide feedback through a structured listening system

- Quickly identify tactical areas for improvement and collect structured information to optimize instant insurance services from a strategic perspective

A key factor in the program’s success was the adoption of a multifunctional approach, involving ITAS’s teams in Marketing, Operations, Claims, and IT/Digital. This ensured smooth and effective implementation of customer listening strategies and facilitated prompt and collaborative action on improvements.

Cristiana Luzi, Partner and CX Advisor at Applied Consulting, led the process: “In the initial phase, we worked with ITAS to assess their current level of Customer Centricity and VoC. We took a collaborative approach, conducting workshops and using methodologies such as Design Thinking to define an effective listening strategy. We also customized and implemented the sandsiv+ platform, integrating it with ITASNOW processes to ensure a continuous flow of data and insights.”

The pilot project ran for 4 months, from January to April 2024, and included several stages:

- Launch of continuous feedback collection and identification of initial process improvement areas

- Introduction of text analysis and refinement of sandsiv+ AI models

- Analysis of pilot results and project closure

During each phase, ITAS used the sandsiv+ platform, powered by generative AI, to gather and analyze customer feedback at four digital touchpoints. This allowed the company to quickly gather valuable insights into what customers appreciate and what the main pain points are, leading to prompt actions to address them.

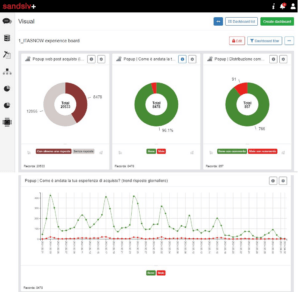

The analytics capabilities of sandsiv+ to quickly identify advocacy drivers or pain points

The results of the pilot project are clear: a 96.1% satisfaction rate for the touchpoint related to purchasing and confirming coverage, along with a positive Net Promoter Score (NPS) of 42 for claims initiation, highlight an extraordinary success.

Real-time visualization of pilot program insights in sandsiv+

ITAS’s team highlighted the strengths and areas for improvement identified by the project.

“ITASNOW customers appreciate the simplicity and speed of the insurance process and the quality of claims assistance. We will continue to invest in these areas. On the product side, we plan to address tactical aspects such as simplifying payment processes and integrating payment methods like PayPal and Apple Pay,” says a representative from ITAS. “Regarding operational management, we are committed to improving the usability and functionality of our online system to provide a complete and integrated service.”

This success exceeded ITAS Mutua’s initial expectations and serves as a catalyst for pursuing excellence in innovation and customer focus. The company will continue to work diligently to maintain and surpass these high performance standards, ensuring an exceptional experience for all ITAS customers.

Project Contacts:

Applied Consulting:

Cristiana Luzi

CX Advisor

cristiana.luzi@appliedconsulting.it | www.appliedconsulting.it

SANDSIV:

Mirko Buonerba

CX Senior Manager

mirko.buonerba@sandsiv.com | sandsiv.com

Contatti Media:

marketing@sandsiv.com

![]()

ITASNOW represents the essential ski insurance offered by ITAS Mutua, the oldest insurance company in Italy, founded in 1821 and recognized for its modern approach. The digitalization of ITASNOW enables fast and easy management to insure your snow adventures, with both daily and seasonal options.